The UK Tech Cluster Group, which brings together tech groups from across the country, has launched a report outlining the steps the next government should take to make sure businesses across the country are able to harness digital innovation.

The report makes these four broad recommendations for the government:

- Create a globally competitive tech talent pipeline in every region of the U.K.

- Encourage digital transformation strategies at a local level.

- Develop a “UK innovation policy” that puts tech at the heart of regional development strategies.

- Do more to support new startups in the regions financially.

How big is the UK tech market?

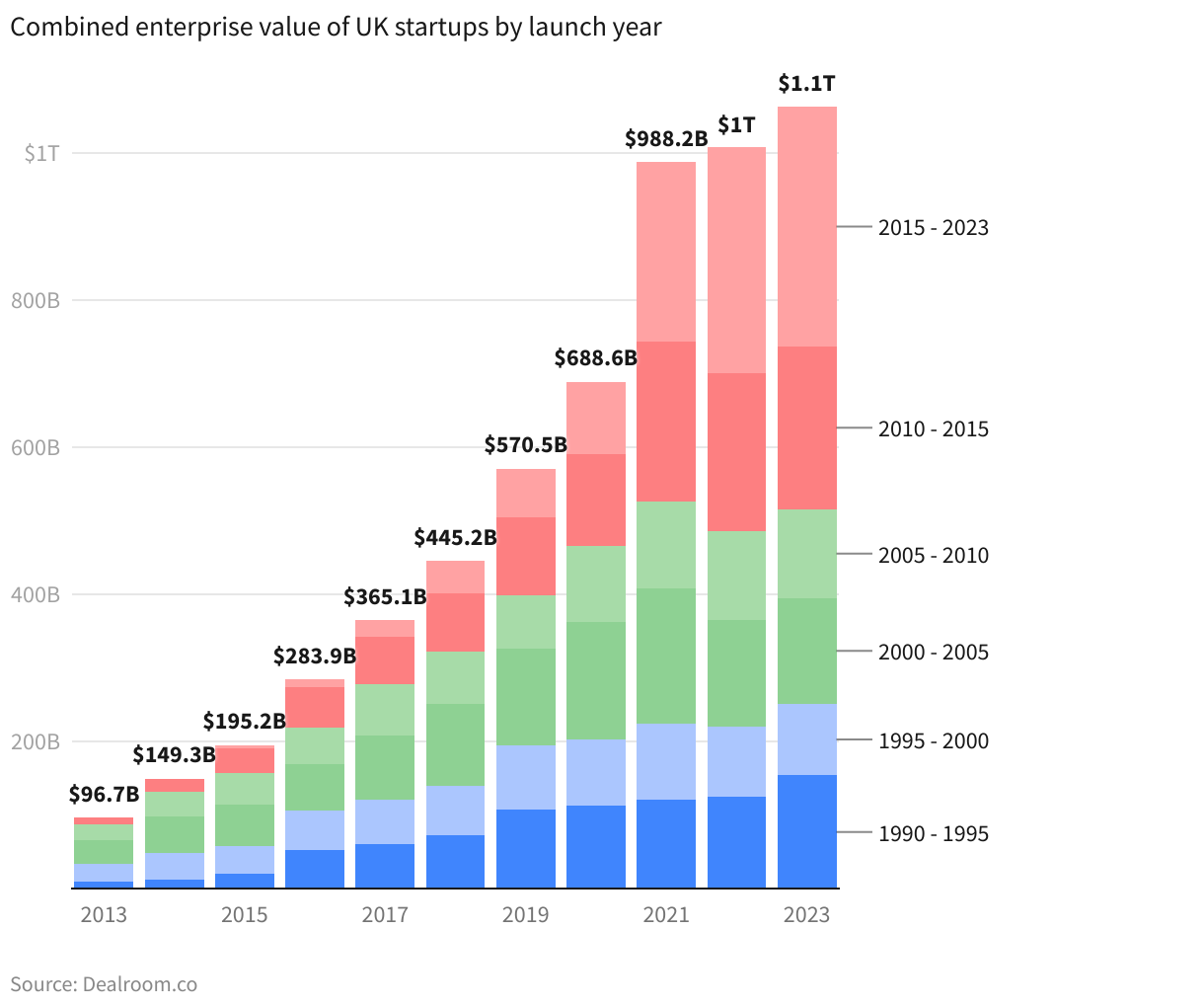

The U.K. has a strong tech ecosystem; in fact, the startup ecosystem was worth around $1.1 trillion in 2023 (£897 billion), according to data from Dealroom (Figure A). Fintech is the largest sector for venture capital investment, followed by healthcare and transportation.

However, that investment is very unevenly spread; the vast majority of the funding goes to companies in London and the South East, including the so-called Golden Triangle made up of London and the university cities of Oxford and Cambridge. London has 87 unicorn companies worth more than $1 billion (£788 million), according to the Dealroom data, whereas the whole of Scotland only has four unicorn companies.

That digital economy is increasingly driving the U.K.’s economic growth. According to research from the Computer & Communications Industry Association, the U.K.’s digital economy and online retail support £227 billion ($288 billion) in economic activity and more than 2.6 million jobs in the U.K., making it the most advanced digital economy in Europe. Average pay in the digital economy stands at about £45,700 per year ($58,000), over £12,000 ($15,000) or 37% more than the £33,400 ($42,000) seen for the U.K. as a whole. Part of the challenge is to help tech businesses flourish more broadly.

“Even though money and opportunities are not evenly distributed, talent is,” said Katie Gallagher, chair of the UKTCG and managing director of Manchester Digital.

“We chose to focus on the four areas that we think impact the regions the most. It’s about making sure every region has a competitive tech talent pipeline. It’s about ensuring that digital innovation is driven from the foundations and ensuring that every company has the opportunity to understand the benefits of integrating digital and technology into their company,” Gallagher told TechRepublic in a Zoom interview.

SEE: Impact of AI on Jobs in the UK: 10-30% of Jobs Could be Automated with AI (TechRepublic)

Around 70% of AI companies are in London and the South East, with just 30% in the rest of the country, and that starts to give you “some sense of the imbalance” in terms of the tech ecosystems across the country, she said.

Driving digital transformation in the U.K.

The UKTCG report said more needs to be done to address tech skills in the U.K. There are a number of different initiatives in the U.K. like apprenticeships, T Levels and coding bootcamps that promise to deliver workers with the right tech skills, but it’s hard for businesses to understand which of these schemes to pay attention to. “The skills landscape is so noisy,” said Gallagher.

UKTCG said that was particularly the case for tech SMEs that are typically new companies and do not have established HR functions or embedded industry networks to call on for advice. SMEs need incentives to take on new talent so more learners from skills programmes can be matched to industry roles, it said.

The report also said that while early adoption of digital technology can drive long-term regional productivity uplift, efforts to encourage this centrally have largely failed, while it notes that “efforts to do this locally have largely succeeded.”

It said more needed to be done to encourage digital adoption and innovation, but this should be delivered at a local level. “The need to drive productivity through digital innovation has not and will not go away,” the report noted. It also said the U.K. government should invest in leadership and management training for tech SMEs.

“Tech firms which have started and grown in our ecosystems should not miss out on support to build their leadership and management capability,” the report said.

“It’s also (about) understanding that not every single business is looking to exit and become a unicorn. It’s about building some of those businesses to sustainable sizes that have good quality jobs. Those mid-sized businesses and those smaller businesses generally are driving the regional economies,” Gallagher said.

Building a broader digital economy in the U.K.

When looking at the U.K. innovation policy, the report said the government should also work to develop programs to encourage collaboration between local firms, local institutions like universities and ambitious tech companies that can encourage regional innovation and business growth.

The report also called for more financial support for tech companies outside of the South East of England.

“Not everyone can afford to experiment in a start-up after graduating, with financial support and connections. Government can encourage a more robust pipeline of new start-ups by considering R&D Tax Credit enhancement and grant funding ‘runway’ support for innovative firms and spinouts outside of the Golden Triangle,” the report said.

Providing targeted tax incentives and runway support schemes would help more innovative ideas to turn into commercial value and good jobs, as noted in the report.

While encouraging the growth of the tech industry beyond the South East might be challenging, the rewards could be significant. Research by industry body techUK found that in London the digital sector’s “gross value added” (a measure of productivity) stood at £9,083 ($11,500), whereas in the West Midlands it stood at £2,055 ($2,605), and in Wales it was just £1,348 ($1,709).

According to techUK, if the six regions with the lowest digital gross value added — those regions are the South West, East Midlands, Yorkshire and the Humber, North East, Northern Ireland and Wales — were able to reach roughly the same level as an average U.K. region, it could contribute an extra £4.8 billion ($6.1 billion) to the U.K. economy, resulting in new jobs, opportunities and growth.