- Top insurance CRM software comparison

- Shape CRM: Best overall insurance CRM

- Freshsales: Best for managing customer profiles

- Zoho CRM: Best for omnichannel communication

- HubSpot: Best for analytics and reporting

- monday CRM: Best for automations

- How do I choose the best insurance CRM software for my business?

- Methodology

An insurance customer relationship management (CRM) software is a solution that helps insurance agencies, providers, or brokers manage all business tasks while maintaining high customer service.

From tracking claims, monitoring policies and managing customer information, these platforms are meant to help reps, managers, and entire businesses streamline their operations. I’ve found that popular general CRM providers like HubSpot, Zoho CRM, and Freshsales offer unique and adaptive solutions for those in the insurance industry.

1

monday CRM

monday CRM

Employees per Company Size

Micro (0-49), Small (50-249), Medium (250-999), Large (1,000-4,999), Enterprise (5,000+)

Any Company Size

Any Company Size

Features

Calendar, Collaboration Tools, Contact Management, and more

3

Capsule CRM

Capsule CRM

Employees per Company Size

Micro (0-49), Small (50-249), Medium (250-999), Large (1,000-4,999), Enterprise (5,000+)

Any Company Size

Any Company Size

Features

Calendar, Collaboration Tools, Contact Management, and more

Top insurance CRM software comparison

Whether you’re a broker, an independent insurance agent, or just in need of a feature-rich tool, you can benefit from CRM software. These providers assist in next-level customer experience while also managing lean and digitized workflows, even on the go. Automating tasks and follow-up can also increase the efficiency of any insurance process.

After identifying which features are priorities, follow general best practices to ensure the tool you pick is enhancing customer satisfaction.

| *Price when billed annually. | |||||

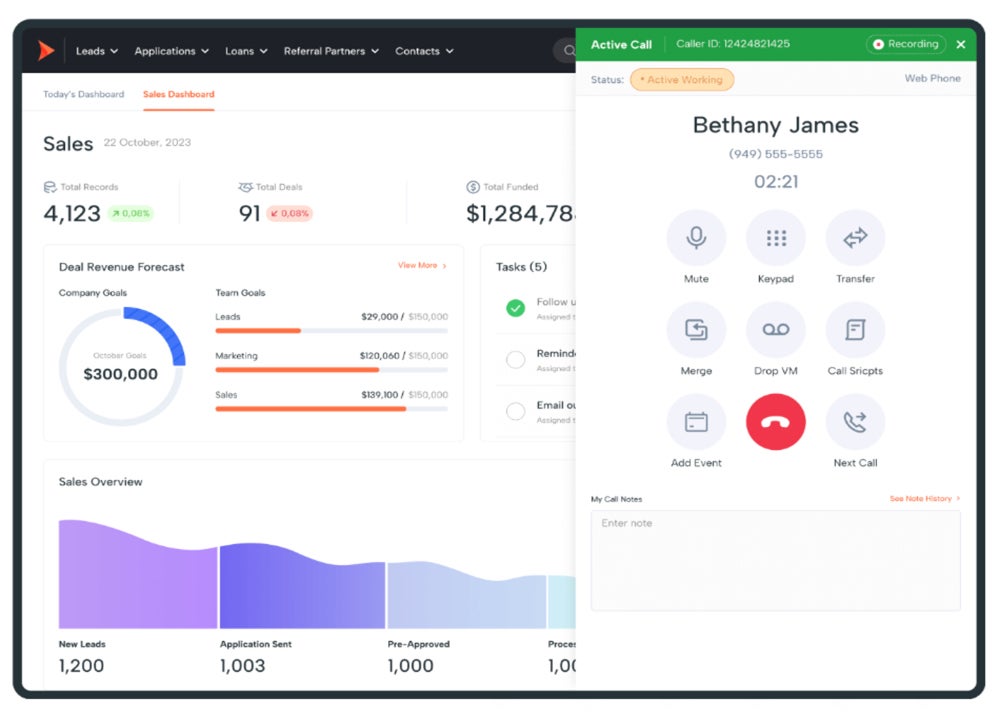

Shape CRM: Best overall insurance CRM

Shape has an all-in-one insurance software that offers a mix of tools and features made for insurance agencies and brokers. The marketing suite simplifies customer engagement by automating personalized emails and texts triggered by specific events, actions, or status updates. With a complete built-in phone system, users can integrate dialer, phone numbers, local presence, IVR call scripts, and more. Plus, the mobile app allows reps to record updates on the go.

Why I chose Shape CRM

Shape is a scalable software that can aid in business growth and help a company expand both geographically and in revenue. It offers a sales CRM, marketing suite, built-in dialers, and even a POS system. The platform interface is also reported by users to be intuitive and easy to navigate.

Shape’s pricing is much higher when compared to other providers on this list that can be implemented at insurance CRMs just as effectively. Because of this, if you’re looking for a more affordable option with similar capabilities in lead management, I recommend Zoho CRM, monday CRM, or Freshsales.

Pricing

- Shape Complete: $119 per user, per month billed annually or $149 per user, per month billed monthly. This is billed per user license for a sales and marketing CRM. $299 activation fee.

- Customer Portal: $47 per user, per month billed annually or $59 per user, per month billed monthly. This is billed per user license for a point of sale platform. No activation fee.

- Landing Pages + CRO: $299 per month billed annually or $359 per month billed monthly. This is for a lead engine tool. $199 activation fee.

Features

- Webphone and dialer: Make and receive calls, drop voicemails, and trigger automatic emails and texts with Shape’s built-in phone system.

- AI lead scoring: Organize lists of leads based on AI predictions and prioritizations that take into account over 700 data points.

- Client portal: Automate current policy gathering, documents, and client follow-up.

Pros and cons

| Pros | Cons |

|---|---|

|

|

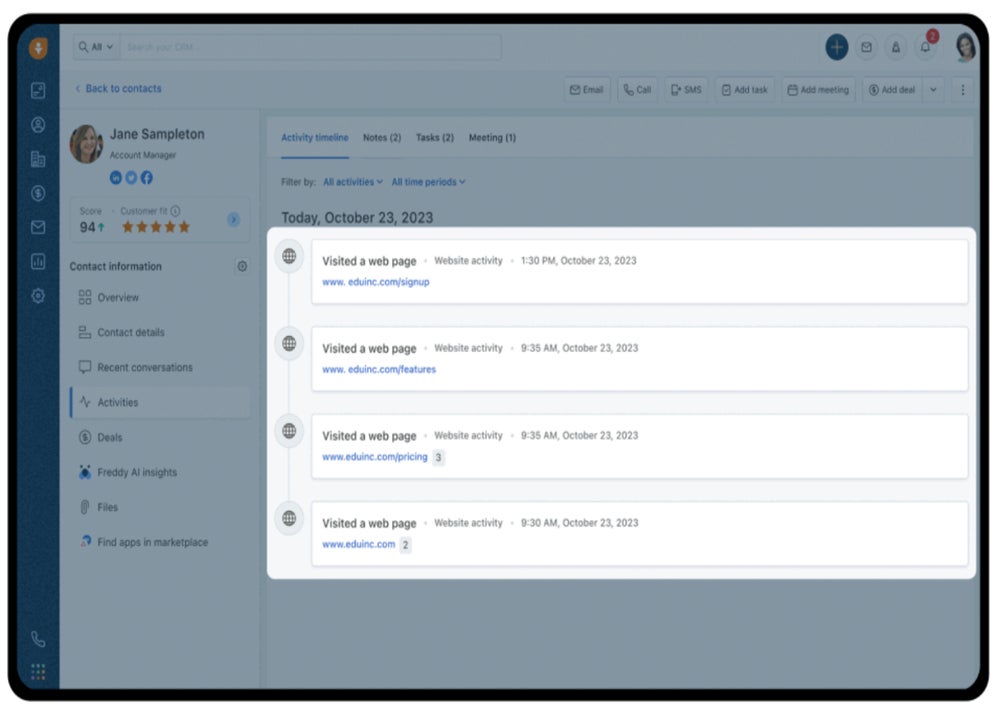

Freshsales: Best for managing customer profiles

Freshsales users have a 360-degree view of all customer engagements and past activities on a single page. Agents can customize the account details page to highlight the fields that are important for their business, such as account details or policy files. This is especially helpful for customers who have signed up for different policies like life, health, or automotive.

Why I chose Freshsales

Freshsales is a top enterprise CRM software for its mix of affordability and advanced technical features. Freshsales offers cross-departmental collaboration from one dashboard and also has AI-powered tools. Freddy is the Freshsales AI assistant that can generate content, prioritize leads and customer tickets, and even pull up reports with forecasts, predictions, and strategy suggestions.

While the free version of Freshsales can be used by startups, it only supports up to three users. If you want to try more features by using a free CRM before committing to a paid subscription, I suggest HubSpot.

For more information, read the full Freshsales review.

Pricing

- Free CRM: Free for up to three users and offers email templates, a sales dashboard, and more.

- Growth: $9 per user per month, billed annually, or $11 per user when billed monthly.

- Pro: $39 per user per month, billed annually, or $47 per user when billed monthly.

- Enterprise: $59 per user per month, billed annually, or $71 per user when billed monthly.

Features

- 360 degree contact page: Understand customers with records of all their activities, files, Freddy AI insights, and intent scores.

- Freddy AI: Find prospects, create personalized emails, and gain insights through the always-available AI assistant.

- Phone routing: Handle all voice interactions, auto-log, and record calls and metrics from the CRM plus plan call routing and greeting during the holidays.

Pros and cons

| Pros | Cons |

|---|---|

|

|

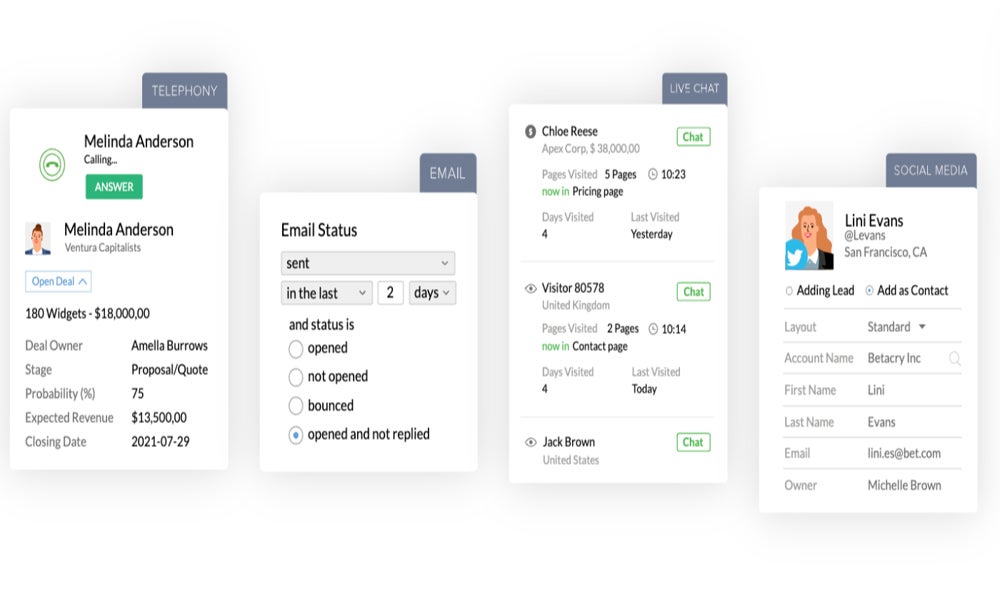

Zoho CRM: Best for omnichannel communication

Zoho CRM’s insurance solution addresses the specific needs of insurance brokers and insurance providers with well-rounded omnichannel communication. Users can organize leads and claims data, automate assignments to the right reps, and manage multiple policies in a single system.

The omnichannel communication offers a combined view of all customer interactions along with real-time notifications across every platform. This way, agents can build lasting relationships and close deals effectively.

Why I chose Zoho CRM

Zoho CRM is an affordable and feature-rich CRM, making it a great option for small businesses. It also provides great marketing tools for agencies looking to invest in advertising and generate new leads. The Zoho AI-powered assistant, Zia, can also help generate content and reports automatically.

If you’re seeking a similar solution to Zoho CRM with even more free sales and marketing tools, I suggest checking out HubSpot.

Read this Zoho CRM review for more insights.

Pricing

- Free CRM: Free for up to three users and comes with lead and document management and a mobile app.

- Standard: $14 per user per month, billed annually, or $20 per user when billed monthly.

- Professional: $23 per user per month, billed annually, or $35 per user when billed monthly.

- Enterprise: $40 per user per month, billed annually, or $50 per user when billed monthly.

- Ultimate: $52 per user per month, billed annually, or $65 per user when billed monthly.

Features

- Omnichannel communication: Engage with customers through email, phone calls, live chat, and social media.

- Multi-page layouts: Handle customer data for multiple policies with multi-page layouts and conditional fields.

- Claim segmentation: Create assignment rules that assign or funnel incoming claims to the best agent or rep to get it addressed quickly.

Pros and cons

| Pros | Cons |

|---|---|

|

|

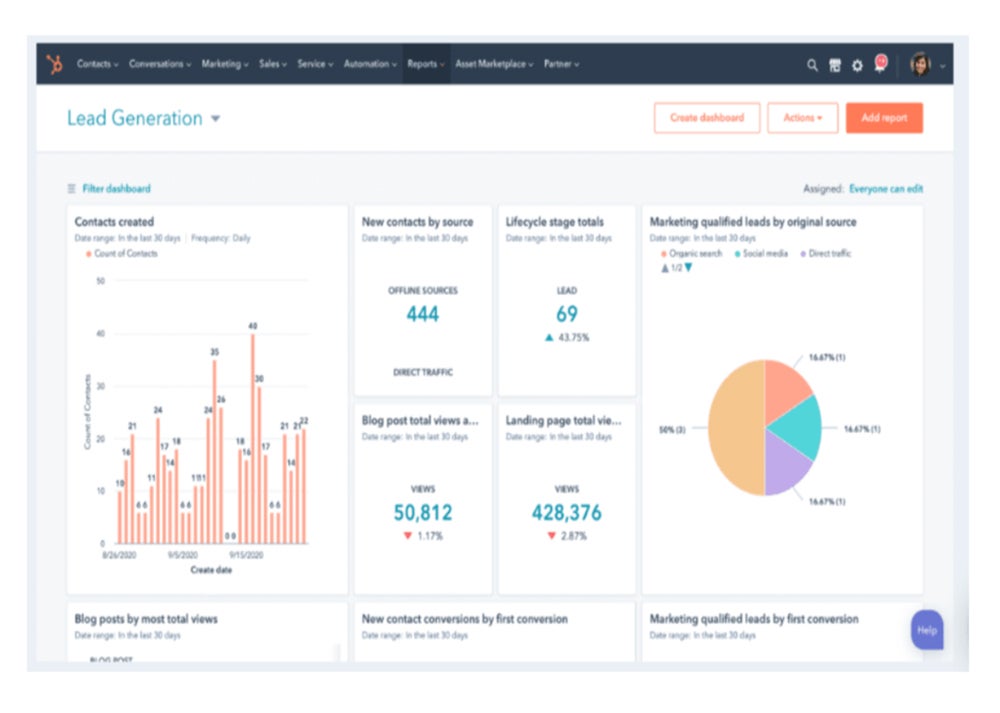

HubSpot: Best for analytics and reporting

HubSpot’s insurance CRM software provides analytics and generates reports for trends, performance, and customer behavior monitoring. The user-friendly dashboard summarizes important data and info to help reps get insights into their sales and marketing campaign performance. Whether your businesses in the health, auto, or life insurance business, HubSpot uses predictive analytics to help identify customers at risk of churn.

Why I chose HubSpot

In addition to being a top-rated free sales CRM, HubSpot also offers a variety of free marketing tools. For example, email marketing templates, social media marketing, and website landing pages can all help further lead generation efforts. HubSpot is also an extremely scalable platform for businesses of any size.

Hubspot’s premium tiers can be considered costly. If you want a comparable tool with advanced reporting capabilities plus AI features for a more affordable price, look into Freshsales.

Check out the full HubSpot review for more detail.

Pricing

- Free CRM: Free for up to five users with contact management, quotes, live chat, and more.

- Sales Hub Starter: $15 per seat per month, billed annually, or $20 when billed monthly.

- Sales Hub Professional: $90 per seat per month, billed annually, or $100 when billed monthly and one-time $1,500 onboarding fee.

- Sales Hub Enterprise: $150 per seat per month, with an annual commitment and one-time $3,500 onboarding fee.

Features

- Lead generation reporting: View comprehensive reports that show visits, open rates, and generated leads from all campaigns.

- Mobile app: Access all the same features on the mobile app so reps and agents can update information while off site.

- Lead distribution: Distribute leads based on interest, agent availability, or geography.

Pros and cons

| Pros | Cons |

|---|---|

|

|

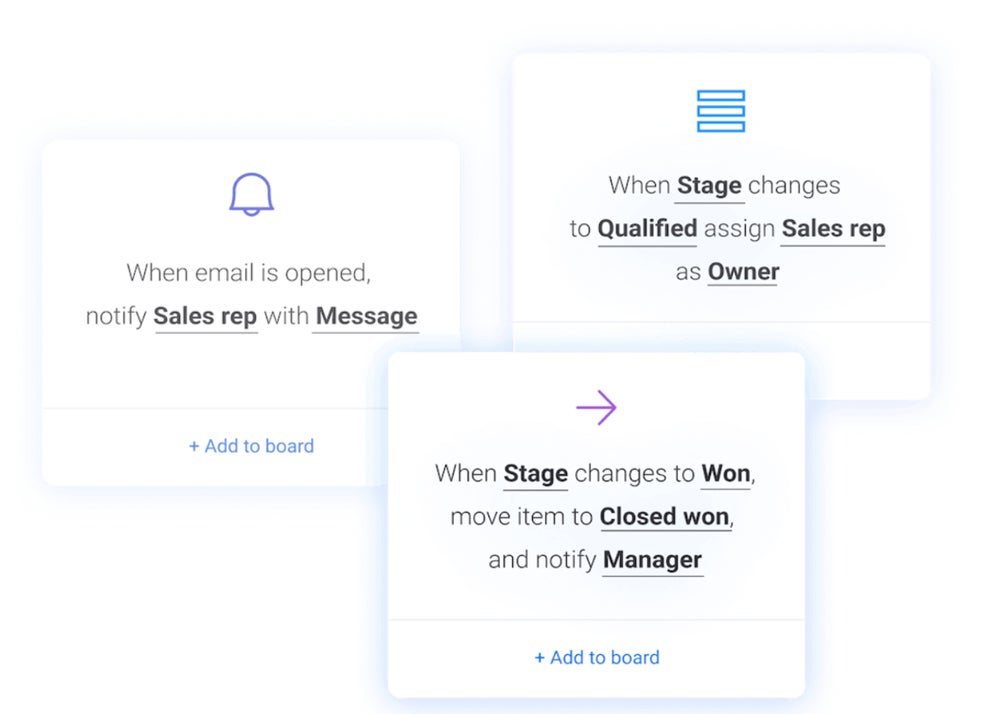

monday CRM: Best for automations

Monday CRM offers advanced automations for insurance agents to adapt. These tech features enable agents to automate repetitive work, centralize customer communication, and reference important documents from one dashboard.

For example, agents can set up notification reminders, create automated alerts when a new lead comes into the system, send automated policy renewal emails, and even streamline customer onboarding.

Why I chose monday CRM

Monday CRM is a sales CRM software best known for its intuitive dashboards and project management capabilites. Insurance agents can visualize data with custom dashboards and detailed reports that reflect deal progress or important sales figures. Monday CRM can also integrate with third-party software.

If you’re looking for a similar provider in terms of automation but with more advanced AI capabilities, I recommend looking into Zoho CRM or Freshsales.

Head over to this monday CRM review for more details.

Pricing

- Free version: Basic CRM offerings only available for students and nonprofit organizations after submitting an application.

- Basic CRM: $12 per user, per month when billed annually, or $15 when billed monthly.

- Standard CRM: $17 per user, per month when billed annually, or $20 when billed monthly.

- Pro CRM: $28 per user, per month when billed annually, or $33 when billed monthly.

- Enterprise CRM: Contact monday.com for a quote

Features

- Sales automations: Create custom automations and workflows that complete tasks quickly while eliminating the risk of human error.

- Reporting and analytics: Build dashboards that collect vital customer data to understand high-level forecasted revenue, goal stages, and more.

- Mobile app: Access customer information on the go while agents are working remotely or visiting customers.

Pros and cons

| Pros | Cons |

|---|---|

|

|

How do I choose the best insurance CRM software for my business?

This list identifies the top insurance CRM providers in the market currently. To narrow them down based on your unique needs, I suggest requesting quotes or demos, or signing up for free versions or trials. This way, you can begin communicating directly with the provider’s sales team.

Below are sample questions or points of consideration I suggest when selecting CRM software:

- What is the total in-market expertise for your industry?

- Is the CRM scalable and detailed enough to fit your business size?

- How does the CRM pricing work for this provider?

- Are their services within your budget? Do you want a free CRM first?

- Does the CRM offer the advanced features you need, such as list segmentation or an AI assistant?

- Does the CRM software integrate with tools you already have in your tech stack?

Methodology

I scored and reviewed each of these CRM providers against my in-house rubric. The rubric is outlined with criteria for standard CRM functionalities. Next, I identified an ideal use case for each software that summarizes the product’s best offerings to help guide you to a solution that fits your insurance needs best.

Here’s the exact breakdown of the scoring criteria I followed when reviewing the top insurance CRM software:

- Cost: Weighted 25% of the total score.

- Core features: Weighted 25% of the total score.

- Customizations: Weighted 15% of the total score.

- Integrations: Weighted 15% of the total score.

- Ease of use: Weighted 10% of the total score.

- Customer support: Weighted 10% of the total score.