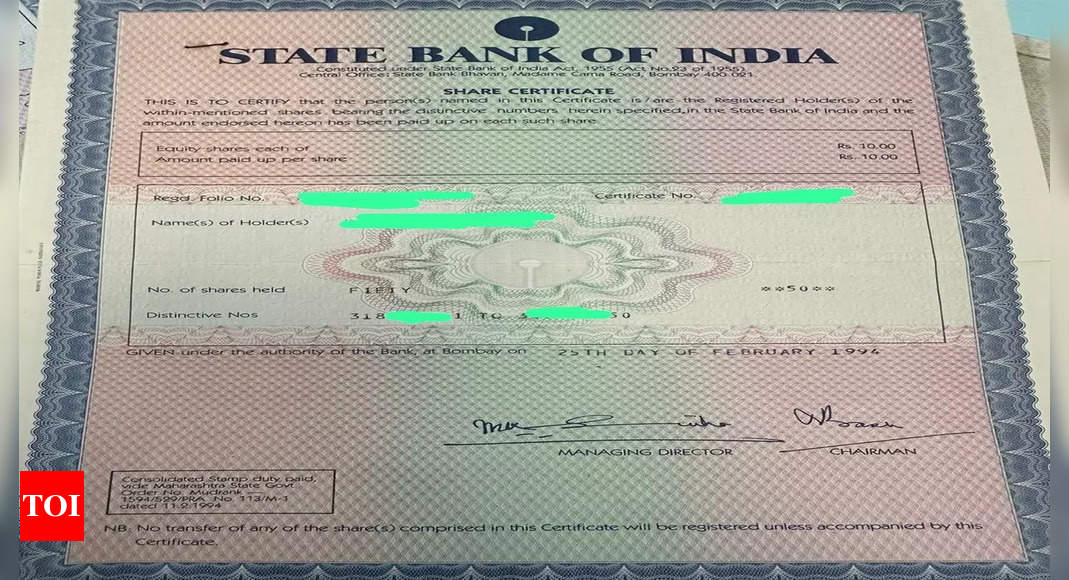

Dr Tanmay Motiwala posted on X (formerly Twitter), a photo of a share certificate belonging to his grandfather mentioning 50 shares with face value Rs 10 issued at a premium and adding that he has sent them for conversion to demat.

“The power of holding equity. Grand parents had purchased SBI shares worth 500 Rs in 1994. They had forgotten about it. Infact they had no idea why they purchased it and if they even hold it. I found some such certificates while consolidating family’s holdings in a place. (Already had sent for converting them to Demat),” posted the user.

Later the user clarified that since the shares were issued at a premium that the actual buy value was Rs 5000. “So the share price opened at a premium at IPO listing and the buying price would be 5000 and not 500. I didn’t know this part as i calculated on face value based on certificate I found. End value stays the same. Again 3.7L or 5L is not a big amount for many people ( accounting for the 1:10 split which makes it 500 shares). But I guess the underlying message was the power of holding equity over long time (if u get it right) and not the maths behind it or bragging anything. It would be some 16% CAGR I guess,” added the user correcting his earlier statement.

The post on the social media platform went viral with other users also sharing their stories. “It happened with me too , my grandfather had 500 shares of SBI, he was am employee , somehow after my fathers death, I got these bonds I was 17 later went to nearer share broker and after some procedure we were able to sell, this how I started to invest in equity,” said an user.

Other users shared their amusement and shock after the revelation as one user called it “proper cinema stuff” while others were simply delighted to read the story.