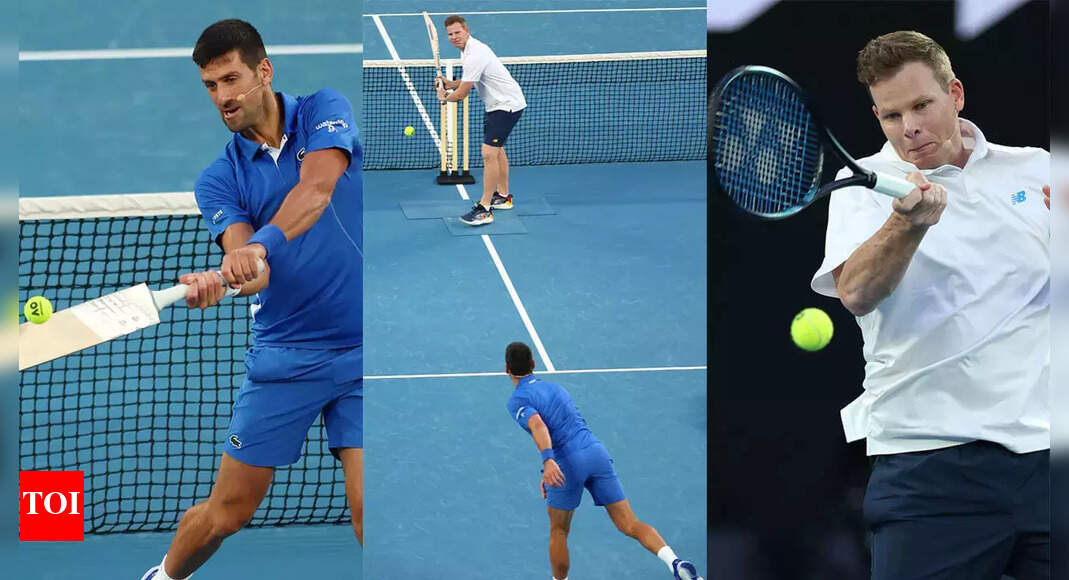

Pawan Passi, former equities executive at Morgan Stanley, arrives at court in New York, US, on Friday, Jan. 12, 2024.

Alex Kent | Bloomberg | Getty Images

Morgan Stanley has agreed to pay a total of $249 million to settle a criminal investigation and a related Securities and Exchange Commission probe of the unauthorized disclosure of block trades to investors by the bank‘s supervisor for such trades and another employee, authorities said Friday.

As part of the settlement, Morgan Stanley entered into a non-prosecution agreement with the U.S. Attorney’s Office for the Southern District of New York for making false statements related to certain block trades executed from 2018 through August 2021, the office said.

Morgan Stanley, which admitted responsibility for its employees’ actions, is obligated under the deal to cooperate with and provide information to U.S. authorities for at least three years.

The SEC charged Morgan Stanley with “failing to enforce its policies concerning the misuse of material non-public information related to block trades,” that agency said.

Block trades typically involve large numbers of shares of a company’s stock in privately arranged transactions executed outside public markets.

The SEC said that the bank generated more than $100 million in illicit profits as a result of misconduct by Pawan Passi, the former head of the bank’s U.S equity syndicate desk.

Passi, 40, has entered into a deferred prosecution agreement with federal prosecutors, subject to approval by a judge. If Passi complies with the terms of that deal and demonstrates good behavior, he will not be prosecuted, prosecutors said.

Passi was ordered to pay a $250,000 civil penalty by the SEC.

Passi admitted that “from 2018 through August 2021, he promised sellers of certain equity blocks that Morgan Stanley would keep information concerning their potential sales confidential, knowing that he would disclose that information to buy-side investors and that those investors would use the information to trade in advance of the block sales,” according to prosecutors.

Passi is due to appear for a hearing Friday morning in Manhattan federal court. His deal does not include a monetary penalty in the criminal case because he had already forfeited about $7.4 million in compensation from Morgan Stanley.

The SEC’s order in the probe says that a former senior member of the syndicate desk participated with Passi in disclosing to certain buy-side investors “non-public, potentially market-moving information” about block trades that Morgan Stanley had been invited to bid on or was negotiating with sellers.

“Those buy-side investors used such information to ‘pre-position’ — or take a short position in — the stock that was the subject of the upcoming block trade,” the SEC order says.

The order said the bank “failed to enforce written policies and procedures” designed to prevent material non-public information from being misused, and also failed to enforce information barriers to prevent such information involving block trades from being discussed by the syndicate desk with the institutional equity division. The syndicate desk is on the bank’s private side, while the equity division conducts trading in public markets.

“Sellers entrusted Morgan Stanley and Passi with material non-public information concerning upcoming block trades with the full expectation and understanding that they would keep it confidential,” said SEC Chairman Gary Gensler.

“Instead, Morgan Stanley and Passi abused that trust by leaking that same information and using it to position themselves ahead of those trades. While their conduct may have earned them tens of millions of dollars on low-risk trades, it violated the federal securities laws,” Gensler said.

Prosecutors said that the non-prosecution deal with Morgan Stanley “recognizes serious misconduct to which Morgan Stanley has admitted and was uncovered by the Government and was no voluntarily self-disclosed.”

But prosecutors also said the agreement recognizes that the bank “provided extraordinary cooperation” with the investigation and that the probe did not find evidence of “corporate management’s complicity in or knowledge of the wrongdoing.”

“Morgan Stanley’s controls, while ultimately unsuccessful in uncovering the misconduct, were designed in part to detect misconduct in the block trades business and were applied in good faith,” the U.S. Attorney’s Office said.

In a statement, Morgan Stanley said, “We are pleased to resolve these investigations and are confident in the enhancements we have made to our controls around block trading, including strengthening our policies, procedures, training and surveillance.”

“The core of this matter is the misconduct of two employees who violated the Firm’s policies, procedures and our core values, as outlined in the settlement documents,” the bank said.

Passi’s lawyer George Canellos said, “We are pleased that the U.S. Attorney’s Office agreed not to pursue a criminal conviction of Mr. Passi in this complex matter. Mr. Passi served clients with skill and delivered great execution quality and prices.”

“The settlements allow Mr. Passi and his family to move past two very difficult years of intense government scrutiny of the block trading practices on Wall Street,” Canellos said.

– Additional reporting by CNBC’s Leslie Picker