The Monetary Policy Committee had last changed the key interest rate in February 2023.

New Delhi:

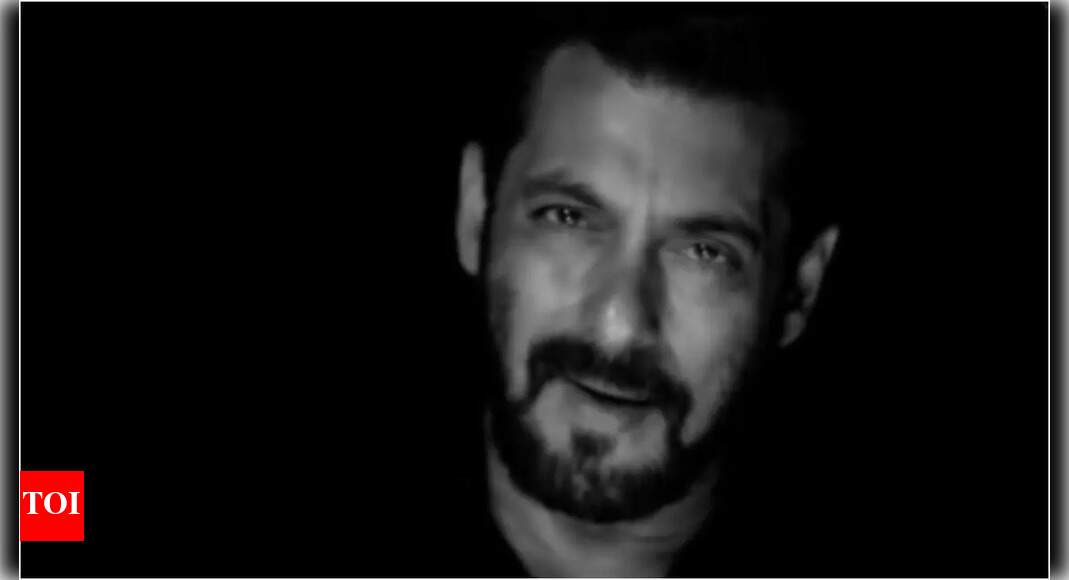

The Reserve Bank of India (RBI) has kept its key interest rate unchanged for the tenth consecutive time, its governor Shaktikanta Das announced today, while retaining India’s real GDP growth forecast at 7.2 per cent for the current financial year.

A six-member Monetary Policy Committee (MPC) headed by Mr Das kept the repo rate unchanged at 6.5 per cent.

This time three new members were inducted into the MPC, replacing outgoing external members. The new external members included in the MPC are Professor Ram Singh, Director, Delhi School of Economics, University of Delhi, Saugata Bhattacharya, economist; and Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development.

They replaced Ashima Goyal, who served as the at emeritus professor, Indira Gandhi Institute of Development Research, Shashanka Bhide, honorary senior advisor, National Council of Applied Economic Research and Jayanth R. Varma, professor at Indian Institute of Management, Ahmedabad (IIM-A).

The decision was announced after the RBI’s three-day monetary policy meeting, which began on October 7.

Mr Das said that inflation for the third quarter (Q3) this fiscal is set to moderately increase to 4.8 per cent, saying that moderation in inflation is likely to remain slow and uneven.

“The inflation horse has been brought to the stable within the tolerance band. We have to be careful about opening the gate,” Mr Das said during the MPC briefing.

The repo rate has remained steady since the RBI adopted a cautious stance to balance inflation control and economic growth.

The committee, which consists of three RBI and three external members, voted 5:1 to keep the repo rate unchanged. It had last changed rates in February 2023.

The MPC also kept the growth projection unchanged at 7.2 per cent for the current financial year.