India’s top IT services firms like TCS and Infosys have set higher fresher recruitment goals for fiscal 2026, encouraged by indicators of renewed technology investment. The six largest IT organisations in the country collectively aim to recruit approximately 82,000 new graduates in the period beginning April 2025, despite reduced hiring in the current fiscal year.

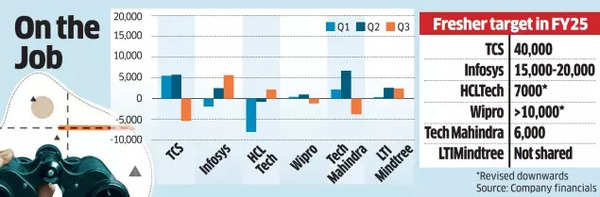

Whilst similar targets were set for FY25, actual recruitment numbers are expected to be lower, according to most companies. The third quarter ending December saw a collective workforce reduction of 225 employees, following positive recruitment figures in the second quarter after seven quarters of stagnation.

The Indian IT sector, valued at $254 billion, experienced a significant reduction of over 70,000 employees in FY24, as clients reduced technology expenditure during a worldwide economic slowdown.

IT Fresher Hiring Targets

- Looking ahead to FY26, industry leader Tata Consultancy Services (TCS) plans to exceed its typical recruitment numbers, targeting more than 40,000 campus freshers, according to an ET report.

- Infosys, their primary competitor, remains committed to hiring over 15,000 freshers in FY25 and anticipates increasing this figure to exceed 20,000 in the following year.

- Wipro, despite falling short of its FY25 commitment to hire 10,000 freshers, has announced plans to recruit between 10,000-12,000 new graduates in the upcoming fiscal year.

Also Read | L&T Chairman, under fire for 90-hour work week comments, received Rs 51 crore pay in FY24

The banking, financial services and insurance (BFSI) sector and North American market have shown promising signs of increased discretionary technology spending during the traditionally slow third quarter (Q3), indicating positive growth prospects for IT companies in FY26.

According to Infosys managing director and CEO Salil Parekh, recruitment expansion reflects the revival in discretionary spending, though subject to seasonal variations in revenue.

The Bengaluru-based technology firm demonstrated robust Q3 performance with 7.6% year-on-year and 1.9% quarter-on-quarter revenue growth, leading to an upward revision of revenue guidance to 4.5-5% for the fiscal year.

Also Read | No company for coders! Why Salesforce, among world’s most-valued software companies, won’t hire more engineers

The December quarter saw Infosys add approximately 5,600 personnel to its workforce.

Recent financial earnings reports indicate that HCLTech and LTIMindtree each added more than 2,000 employees to their respective workforces during the December quarter.

HCLTech, based in Noida, has reduced its FY25 fresher recruitment target from 10,000 to 7,000, citing enhanced productivity and reduced attrition. However, chief people officer Ramachandran Sundararajan confirmed higher hiring projections for FY26.

The company anticipates recruiting more university graduates in FY26 compared to FY25.

Sundararajan emphasised the company’s commitment to specialisation-focused hiring, noting consistent success in meeting demand through recruitment efforts over the past four quarters.

The December quarter saw significant workforce reductions, with TCS recording the largest decrease of 5,370 employees, whilst Tech Mahindra and Wipro reduced their staff by 3,785 and 1,157 respectively.

During this traditionally quiet period, marked by furloughs and reduced working days, outsourcing companies implemented cost-cutting measures whilst leveraging productivity improvements through generative artificial intelligence (GenAI).

Companies maintained that these reductions were seasonal and not indicative of overall demand conditions.

Top IT firms have reported a sequential rise in their last twelve-month (LTM) attrition rates, indicating a gradual recovery in demand. However, LTIMindtree experienced a slight decrease of 20 basis points (0.20%) compared to the previous quarter.

In the past decade, the outsourcing sector has experienced significant attrition rates, reaching up to 30% at its peak, primarily due to limited compensation and career advancement prospects at junior levels. Following the Covid-19 pandemic, these rates have decreased to 10-15%, influenced by the economic slowdown and reduced business demand over the last two financial years.

“We see this (drop in headcount) getting ironed out in the coming quarter. That was more of a seasonal thing because we purposely onboarded fewer freshers in Q3 than what we will in Q4,” stated Saurabh Govil, chief human resource officer at Wipro, explaining that recruitment strategies are influenced by demand and productivity factors.