FILE PHOTO: AI (Artificial Intelligence) letters are placed on computer motherboard in this illustration taken June 23, 2023.

The 2022-23 report on the trends in, and progress of, banking in India, which was released on Wednesday by the Reserve Bank of India (RBI), studies the use of Artificial Intelligence (AI) in banks and how it has grown over time. To assess the level of awareness and readiness for adopting AI in Indian banks, an analytical study was conducted on banks’ annual reports by the RBI staff between 2015-16 and 2021-22.

This study employed a textual analysis method by matching keywords specific to the domain and utilising named entity recognition techniques. It leveraged widely recognised AI and Machine Learning (ML) dictionaries and glossaries from sources such as Google Vertex AI, Google Developers, IBM, NHS AI Lab, and the Council of Europe. Additionally, insights from Large Language Models such as ChatGPT and Bard were integrated into the analysis.

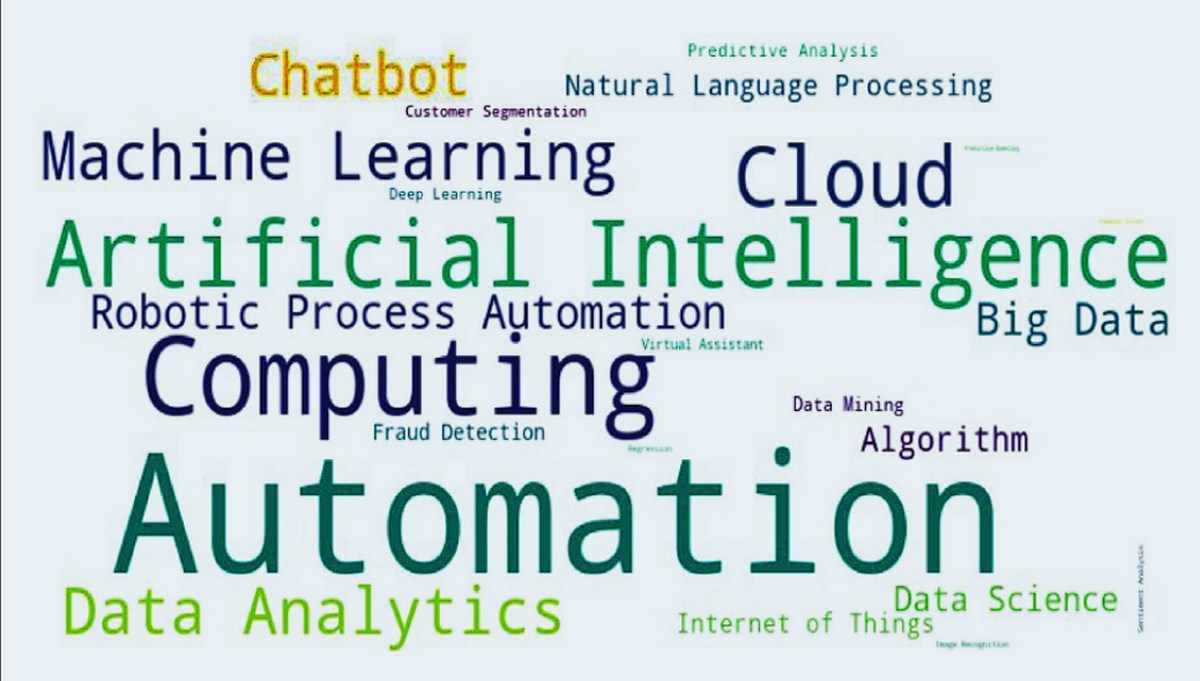

Chart 1 | The chart shows a word cloud showing textual analysis of AI-related keywords in the bank’s annual report.

Charts appear incomplete? Click to remove AMP mode

The analysis using a word cloud indicates a significant emphasis by banks on automation (Chart 1). This trend likely stems from the goal of improving efficiency and enhancing capabilities in the detection of fraud and other forms of predictive analytics, the RBI study suggests. It is also notable that there is an awareness or potential for adopting emerging technologies such as Robotic Process Automation, the Internet of Things, and Natural Language Processing.

A key application of AI in various service sectors is the use of chatbots, which are capable of engaging in conversations with human users in natural languages, either via text or voice.

Chart 2 | The chart shows the number of banks in India which adopted chatbots. in total, 33 scheduled commercial banks were analysed.

In FY17, only five banks had opted for this facility. This incrementally grew in the following years. Now, 26 banks have this facility.

Chart 3 | The chart shows the share of banks in India which have adopted chatbots by the end of June 2023.

Over 78.8% of the banks have adopted this facility — i.e., 26 out of the 33 scheduled commercial banks analysed. According to the study, 11 out of 12 public sector banks (PSBs) had some form of chatbot and virtual assistant by using AI and ML technologies, by the end of June 2023. On the other hand, only 15 out of 21 private sector banks (PVBs) had them.

Click to subscribe to our data newsletter line

Chart 4 | The chart shows the growth in the share of PSBs and PVBs which adopted chatbots over the years.

The share of PVBs with chatbots was significantly higher than the share of PSBs in FY17. However, the situation reversed in the following years, with the trend of large-scale mergers among the PSBs appearing to have influenced the adoption of chatbots, as merged entities often adopt the technology from their acquiring banks. According to the RBI study, non-banking financial corporations have also started introducing chatbots for customer services.

AI tools are extensively adopted and heavily utilised in areas such as fraud detection, optimising information technology operations, and digital marketing. The study argues that banks can improve efficiency and provide better customer experiences by leveraging these applications. The use of ML techniques for real-time analysis of customer transactions enhances the estimation of default risks. This bolsters their risk management strategies, the study suggests.

However, the study also ends with a cautionary note. AI in finance might heighten existing risks and introduce new ones, such as consumer protection concerns. The opaque functioning of AI models complicates compliance with laws, regulations, and internal controls in financial firms. These models could trigger market shocks and amplify systemic risks, particularly in terms of procyclicality, the study warns.

Source: ‘Adoption of Artificial Intelligence in Indian Banks’, published in the Report on Trends and Progress of Banking in India 2022-23 by the Reserve Bank of India.

Also read: Data | Private banks on a housing loan spree, 99% pay dues on time as of now

Listen to our Data podcast: Examining the 70-Hour Work Week: Insight or Imposition by Infosys’ Narayana Murthy | Data Point Podcast