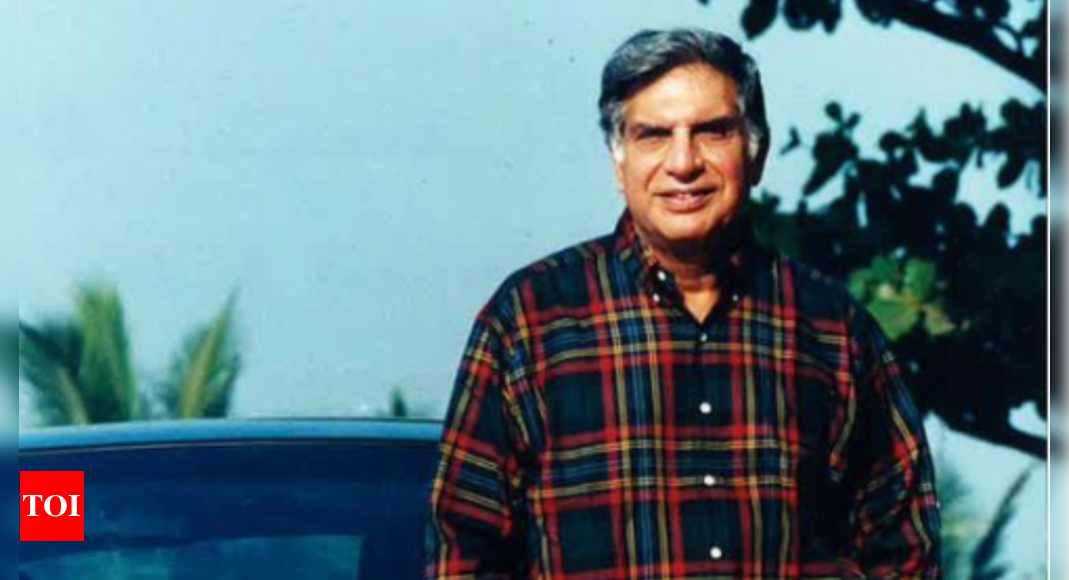

Tata Group today boasts a staggering revenue of $165 billion, but back in 1991, when Ratan Tata took the helm, the picture was far less impressive with $4 billion in annual turnover.

Inheriting a fragmented and bureaucratic empire, Tata didn’t just add zeros to the top line through innovations, new business ventures, and international expansions, but also transformed how the group operated.By 2012, when he hung up his boots, the group had smashed through the $100-billion barrier, becoming the first Indian conglomerate to reach such heights.

While he joined the group in 1962 as an assistant in Tata Industries, he stepped into the chairman’s shoes only in March 1991, when the conglomerate was dominated by an old guard, operating its divisions as semi-autonomous kingdoms, rooted in his predecessor JRD Tata’s culture of decentralisation. He removed the satraps one by one, centralising power in Bombay House, the group’s HQ.

His leadership coincided with India’s economic liberalisation in the early nineties, a moment he seized amid both opportunities and threats, including the rise of competitive markets following the end of the licence raj. Tata made bold decisions, selling off underperforming sectors like cement, textiles, cosmetics, and pharmaceuticals, while doubling down on existing businesses like software and steel, and entering new sectors like telecommunications, passenger cars, insurance, finance, retail, and aviation.

His collaborative approach led to partnerships with international giants like Cummins, AIA, and Starbucks, enabling the group to manufacture automotive engines, sell insurance, and offer coffee from Kargil to Kochi. Acquisitions like Jaguar-Land Rover and Corus not only fortified the group’s portfolio but also propelled it to international prominence, with over 60% of its revenues coming from operations across more than 100 countries by the end of his tenure.

Central to Tata’s success strategy was his overhaul of corporate governance. He ensured that all businesses derived their strength from Tata Sons, the holding company. The company increased stakes in key units to over 26%, shielding them from hostile takeovers, such as the 2001 threat faced by Voltas from Lok Prakashan. He mandated that all group companies pay royalties to Tata Sons for using the Tata name, culminating in a new three-dimensional, blue-coloured logo that amplified brand value from $300 million in 1998 to a staggering $11 billion by 2012.

In 2004, he took TCS public, raising $1.2 billion in India’s largest and Asia’s second-largest IPO at the time. In fact, TCS was the only major company from the group he took public. The capital raised through the IPO allowed for further acquisitions and increased stakes in Tata companies, fortifying the group’s financial foundation.

However, Tata’s journey with the group was not without its challenges. In the late nineties, Tata Consumer found itself ensnared in a crisis when ULFA militants targeted its tea gardens for funding, throwing the company into turmoil. Additionally, the launch of the Indica car in 1998 resulted in a Rs 500-crore loss for Tata Motors in fiscal 2000, leading to shareholder discontent and Tata’s offer to resign from the chairmanship.

Tata Nano Launch Event – Part I

Nevertheless, his commitment to innovation led to the launch of the Nano in 2005, touted as the world’s cheapest car, although that too ran into trouble. The group also encountered a major financial scandal in 2001, with a Rs 500-crore fraud uncovered at Tata Finance. Tata stepped in, assuring investors that their money would be repaid. But perhaps the most harrowing moment of his career came on Nov 26, 2008, when the terrorist attack on the Taj Mahal Palace Hotel unfolded before his eyes.

Tata retired in Dec 2012 but returned briefly as chair from Oct 2016 to Feb 2017 to address leadership challenges within the group. As Tata Group continues to flourish under the guidance of his successors, Ratan Tata’s legacy is firmly etched in the annals of Indian business history. His foresight, determination, and resilience have not only transformed the Tata Group but have also left an indelible mark on the Indian economy.